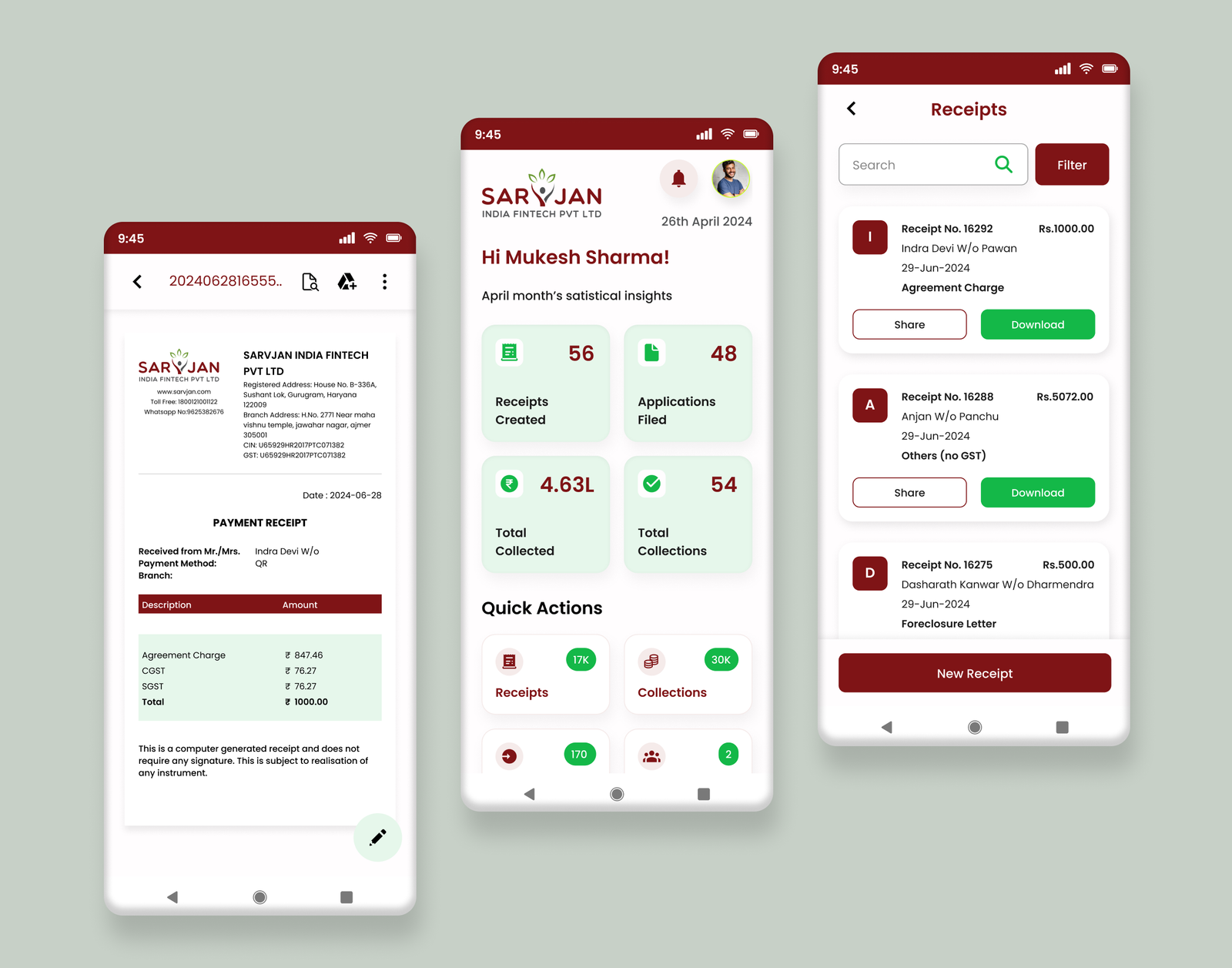

Sarvjan Connect

Sarvjan Fintech Pvt. Ltd., a fast-growing NBFC, relied heavily on manual spreadsheets and paper-based approvals that slowed down operations and created reconciliation challenges. ITzak Technologies stepped in to design a complete digital ecosystem that streamlined their lending workflow from application to repayment.

Our custom-built Loan Origination System (LOS), Loan Management System (LMS), and Collections Platform replaced fragmented manual processes with a secure, cloud-based infrastructure. Through automation of KYC, EMI scheduling, collections, and reporting, the platform delivered real-time transparency and control across branches and agents.

The transformation not only accelerated loan approvals and improved collection efficiency but also enabled Sarvjan Fintech to scale operations seamlessly while maintaining regulatory compliance and data integrity.

Get it NowWe delivered

We delivered a fully integrated fintech suite - LOS, LMS, and Collections Platform - customized for Sarvjan Fintech’s lending model. The system digitized every stage of the loan lifecycle, providing automation, real-time monitoring, and operational transparency.